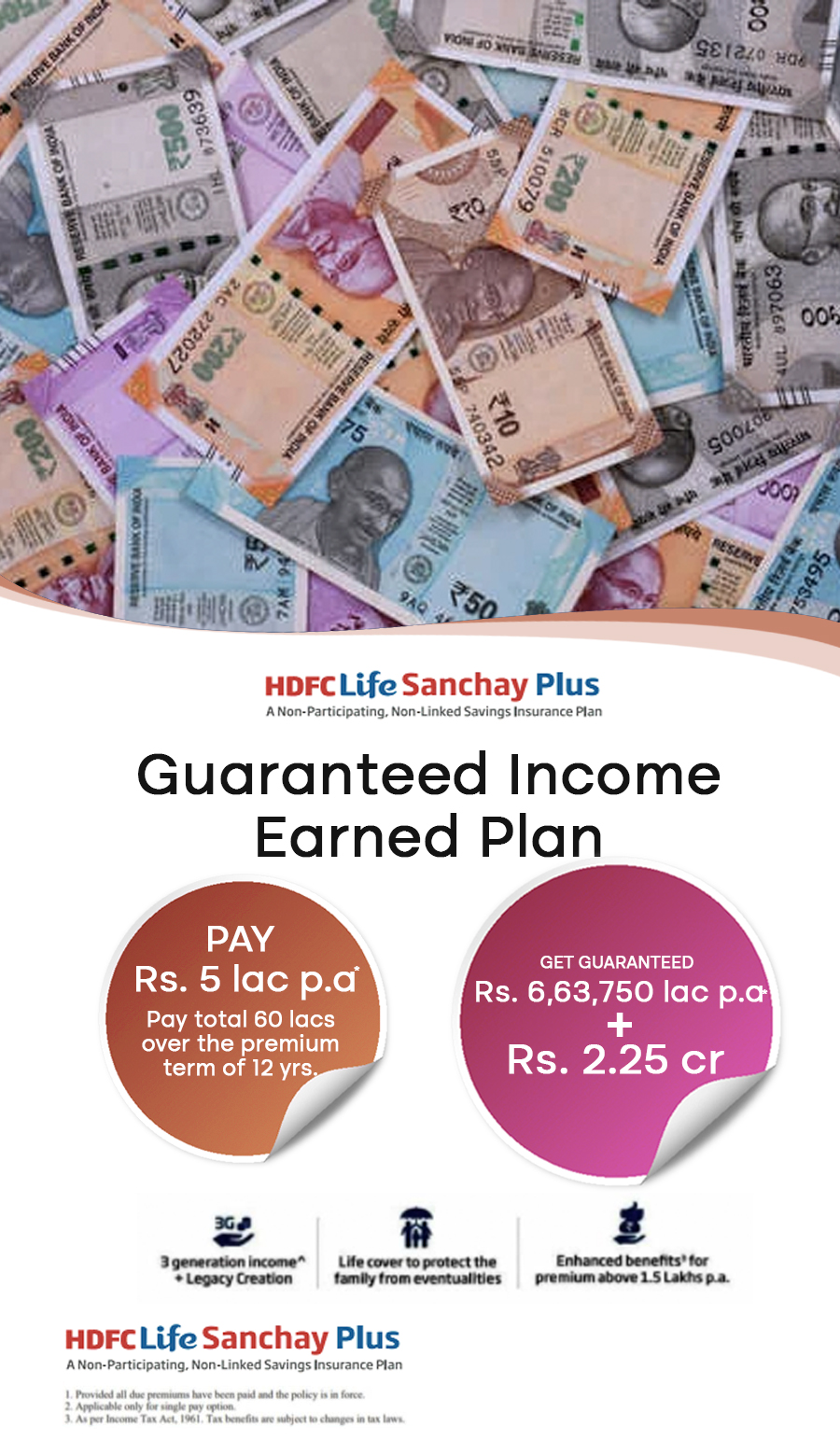

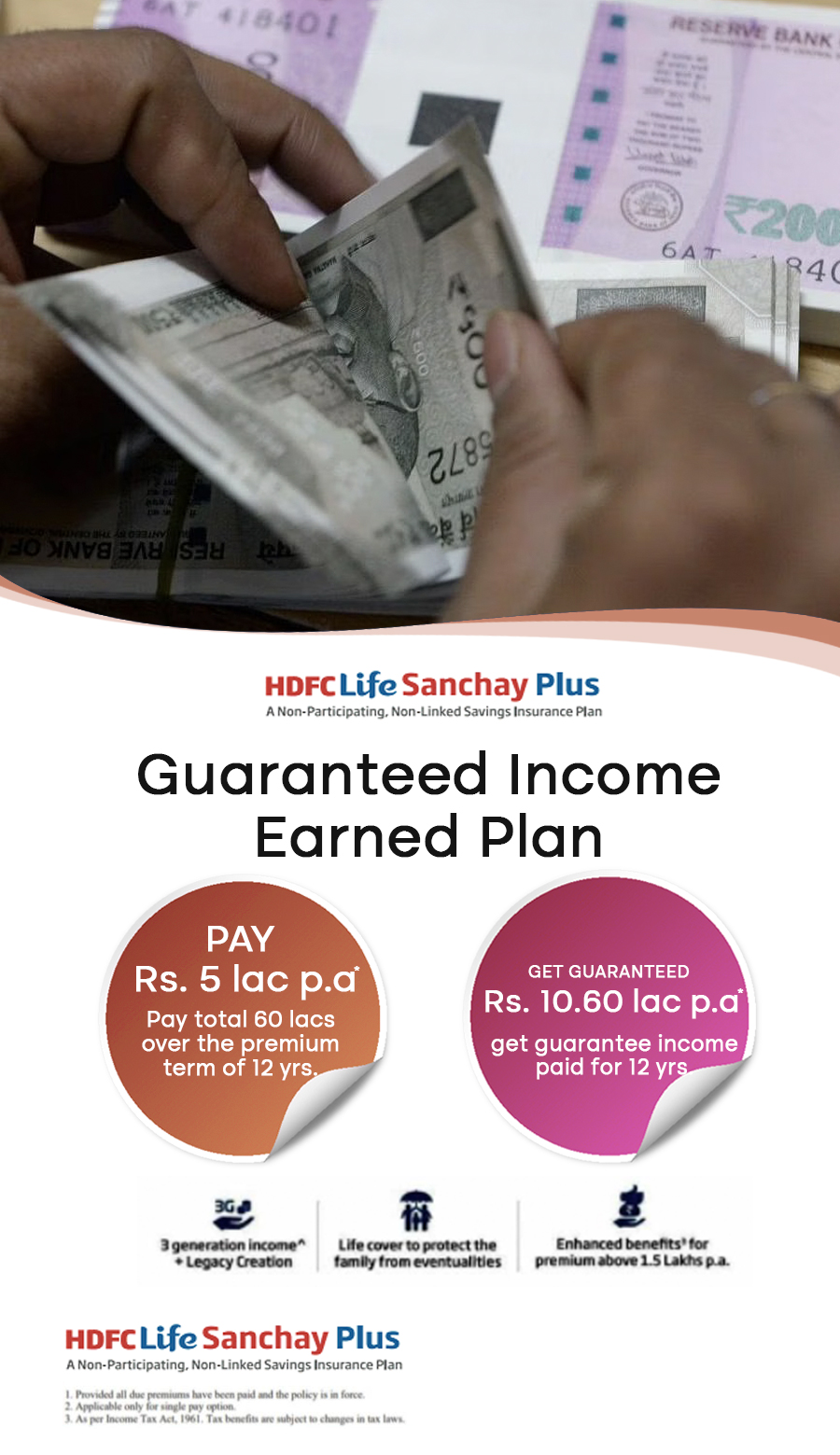

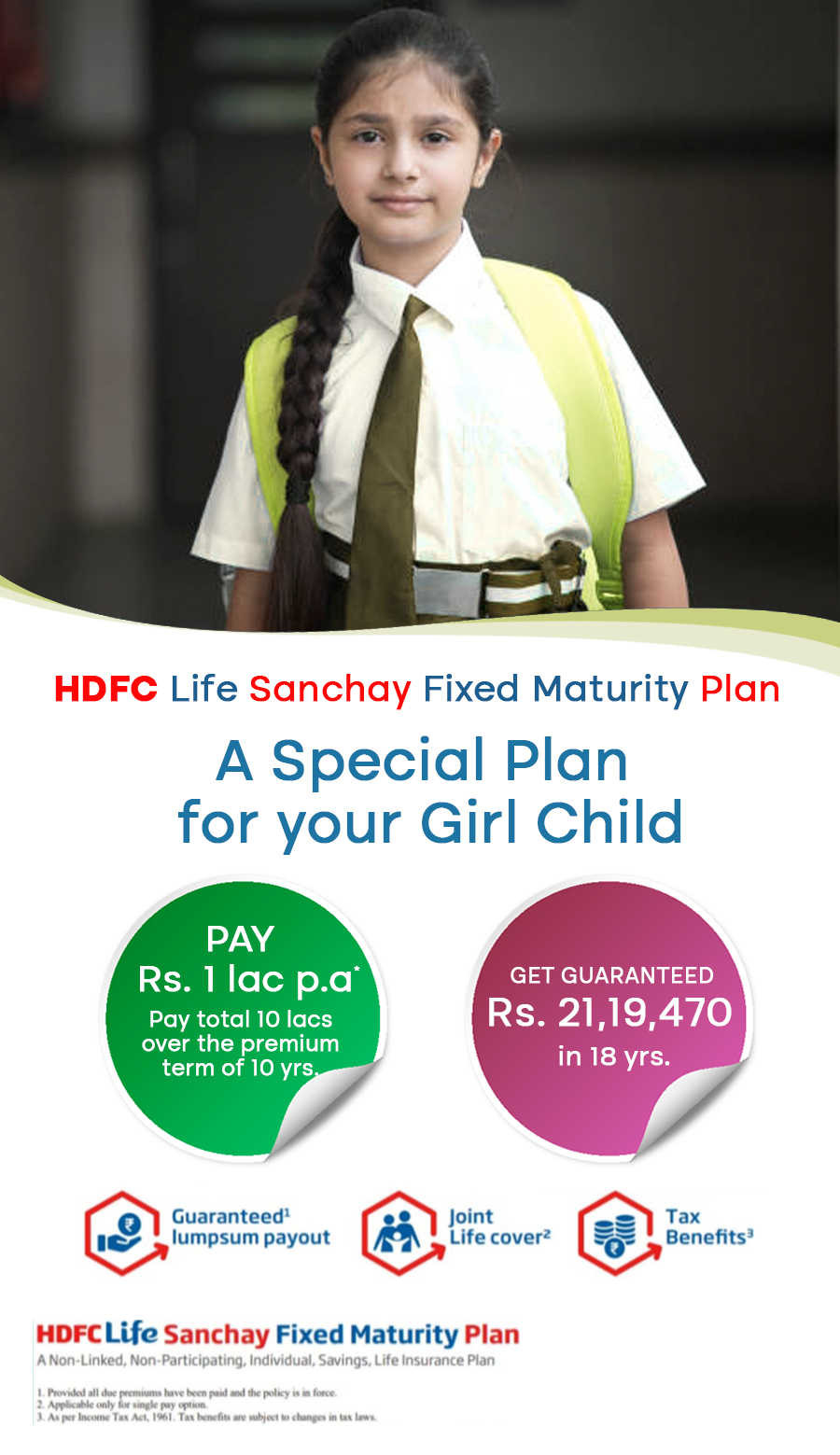

Best HDFC Life Plans for You

HDFC Sanchay Plus, HDFC Sanchay Fixed Maturity Plans & Many More for you.

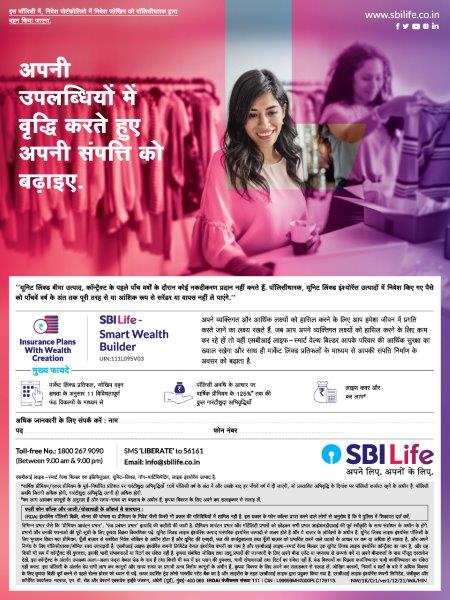

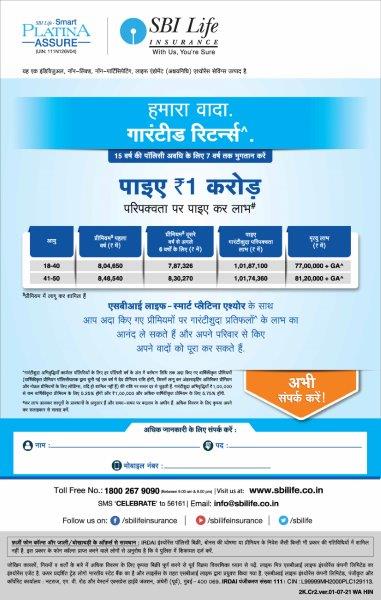

Best SBI Life Plans for You

Best SBI Life Plans for every Phrase of your Life.

What Is Life Insurance?

Life insurance is a contract between an insurer and a policy owner. A life insurance policy guarantees the insurer pays a sum of money to named beneficiaries when the insured dies in exchange for the premiums paid by the policyholder during their lifetime.

The life insurance application must accurately disclose the insured’s past and current health conditions and high-risk activities to enforce the contract.

Types of Life Insurance

Many different types of life insurance are available to meet all sorts of needs and preferences. Depending on the short- or long-term needs of the person to be insured, the major choice of whether to select temporary or permanent life insurance is important to consider.

Term life insurance

Term life insurance lasts a certain number of years, then ends. You choose the term when you take out the policy. Common terms are 10, 20, or 30 years. The best term life insurance policies balance affordability with long-term financial strength.

- Decreasing term life insurance is renewable term life insurance with coverage decreasing over the life of the policy at a predetermined rate.

- Convertible term life insurance allows policyholders to convert a term policy to permanent insurance.

- Renewable term life insurance provides a quote for the year the policy is purchased. Premiums increase annually and are usually the least expensive term insurance in the beginning.

Permanent Life Insurance

Permanent life insurance stays in force for the insured’s entire life unless the policyholder stops paying the premiums or surrenders the policy. It’s typically more expensive than term.

- Whole life insurance is a type of permanent life insurance that accumulates cash value. Cash-value life insurance allows the policyholder to use the cash value for many purposes, such as a source of loans or cash or to pay policy premiums.

- Universal Life (UL) is a type of permanent life insurance with a cash value component that earns interest. Universal life features flexible premiums. Unlike term and whole life, the premiums can be adjusted over time and designed with a level death benefit or an increasing death benefit.

- Indexed universal (IUL) is a type of universal life insurance that lets the policyholder earn a fixed or equity-indexed rate of return on the cash value component.

- Variable universal life insurance allows the policyholder to invest the policy’s cash value in an available separate account. It also has flexible premiums and can be designed with a level death benefit or an increasing death benefit.

Term vs. Permanent Life Insurance

Term life insurance differs from permanent life insurance in several ways but tends to best meet the needs of most people. Term life insurance only lasts for a set period of time and pays a death benefit should the policyholder die before the term has expired. Permanent life insurance stays in effect as long as the policyholder pays the premium. Another critical difference involves premiums—term life is generally much less expensive than permanent life because it does not involve building a cash value.

Before you apply for life insurance, you should analyze your financial situation and determine how much money would be required to maintain your beneficiaries’ standard of living or meet the need for which you’re purchasing a policy.

For example, if you are the primary caretaker and have children 2 and 4 years old, you would want enough insurance to cover your custodial responsibilities until your children are grown up and able to support themselves.

You might research the cost of hiring a nanny and a housekeeper or using commercial child care and cleaning services, then perhaps add some money for education. Include any outstanding mortgage and retirement needs for your spouse in your life insurance calculation. Especially if the spouse earns significantly less or is a stay-at-home parent. Add up what these costs would be over the next 16 or so years, add more for inflation, and that’s the death benefit you might want to buy—if you can afford it.

Burial or final expense insurance is a type of permanent life insurance that has a small death benefit. Despite the names, beneficiaries can use the death benefit as they wish.

How Much Life Insurance to Buy

Many factors can affect the cost of life insurance premiums. Certain things may be beyond your control, but other criteria can be managed to potentially bring down the cost before applying.

After being approved for an insurance policy, if your health has improved and you’ve made positive lifestyle changes, you can request to be considered for change in risk class. Even if it is found that you’re in poorer health than at the initial underwriting, your premiums will not go up. If you’re found to be in better health, then you can expect your premiums to decrease.

Step 1: Determine How Much You Need

Think about what expenses would need to be covered in the event of your death. Things like mortgage, college tuition, and other debts, not to mention funeral expenses. Plus, income replacement is a major factor if your spouse or loved ones need cash flow and are not able to provide it on their own.

There are helpful tools online to calculate the lump sum that can satisfy any potential expenses that would need to be covered.

What Affects Your Life Insurance Premiums and Costs?

Step 2: Prepare Your Application

- Age: This is the most important factor because life expectancy is the biggest determinant of risk for the insurance company.

- Gender: Because women statistically live longer, they generally pay lower rates than males of the same age.

- Smoking: A person who smokes is at risk for many health issues that could shorten life and increase risk-based premiums.

- Health: Medical exams for most policies include screening for health conditions like heart disease, diabetes, and cancer and related medical metrics that can indicate risk.

- Lifestyle: Dangerous lifestyles can make premiums much more expensive.

- Family medical history: If you have evidence of major disease in your immediate family, your risk of developing certain conditions is much higher.

- Driving record: A history of moving violations or drunk driving can dramatically increase the cost of insurance premiums.

Life Insurance Buying Guide

Life insurance applications generally require personal and family medical history and beneficiary information. You will also likely need to submit to a medical exam. You will need to disclose any preexisting medical conditions, history of moving violations, DUIs, and any dangerous hobbies such as auto racing or skydiving.

Standard forms of identification will also be needed before a policy can be written, such as your Social Security card, driver’s license, or U.S. passport.

Step 3: Compare Policy Quotes

When you’ve assembled all of your necessary information, you can gather multiple life insurance quotes from different providers based on your research. Prices can differ markedly from company to company, so it’s important to take the effort to find the best combination of policy, company rating, and premium cost. Because life insurance is something you will likely pay monthly for decades, it can save an enormous amount of money to find the best policy to fit your needs.

Benefits of Life Insurance

There are many benefits to having life insurance. Below are some of the most important features and protections offered by life insurance policies.

Most people use life insurance to provide money to beneficiaries who would suffer a financial hardship upon the insured’s death. However, for wealthy individuals, the tax advantages of life insurance, including the tax-deferred growth of cash value, tax-free dividends, and tax-free death benefits, can provide additional strategic opportunities.

Avoiding Taxes

The death benefit of a life insurance policy is usually tax-free.1 Wealthy individuals sometimes buy permanent life insurance within a trust to help pay the estate taxes that will be due upon their death. This strategy helps to preserve the value of the estate for their heirs.

Tax avoidance is a law-abiding strategy for minimizing one’s tax liability and should not be confused with tax evasion, which is illegal.

Who Needs Life Insurance?

Life insurance provides financial support to surviving dependents or other beneficiaries after the death of an insured policyholder. Here are some examples of people who may need life insurance:

- Parents with minor children. If a parent dies, the loss of their income or caregiving skills could create a financial hardship. Life insurance can make sure the kids will have the financial resources they need until they can support themselves.

- Parents with special-needs adult children. For children who require lifelong care and will never be self-sufficient, life insurance can make sure their needs will be met after their parents pass away. The death benefit can be used to fund a special needs trust that a fiduciary will manage for the adult child’s benefit.2

- Adults who own property together. Married or not, if the death of one adult would mean that the other could no longer afford loan payments, upkeep, and taxes on the property, life insurance may be a good idea. One example would be an engaged couple who take out a joint mortgage to buy their first house.

- Seniors who want to leave money to adult children who provide their care. Many adult children sacrifice time at work to care for an elderly parent who needs help. This help may also include direct financial support. Life insurance can help reimburse the adult child’s costs when the parent passes away.

- Young adults whose parents incurred private student loan debt or cosigned a loan for them. Young adults without dependents rarely need life insurance, but if a parent will be on the hook for a child’s debt after their death, the child may want to carry enough life insurance to pay off that debt.

- Children or young adults who want to lock in low rates. The younger and healthier you are, the lower your insurance premiums. A 20-something adult might buy a policy even without having dependents if there is an expectation to have them in the future.

- Stay-at-home spouses. Stay-at-home spouses should have life insurance as they have significant economic value based on the work they do in the home. According to Salary.com, the economic value of a stay-at-home parent would have been equivalent to an annual salary of $162,581 in 2018.

- Wealthy families who expect to owe estate taxes. Life insurance can provide funds to cover the taxes and keep the full value of the estate intact.

- Families who can’t afford burial and funeral expenses. A small life insurance policy can provide funds to honor a loved one’s passing.

- Businesses with key employees. If the death of a key employee, such as a CEO, would create a severe financial hardship for a firm, that firm may have an insurable interest that will allow it to purchase a life insurance policy on that employee.

- Married pensioners. Instead of choosing between a pension payout that offers a spousal benefit and one that doesn’t, pensioners can choose to accept their full pension and use some of the money to buy life insurance to benefit their spouse. This strategy is called pension maximization.

- Those with preexisting conditions. Such as cancer, diabetes, or smoking. Note, however, that some insurers may deny coverage for such individuals, or else charge very high rates.

We ensure your Investment

Lalaji Invest has been in the business of investment for more than a decade. We are happy to announce that we are now providing investment on our Website also. Feel free to give us a call & we will be more than happy to assist you decide the best plan according to your requirements. Let’s make a Financially secured India!!

Client's we work with

————————

Segment Type: Cash And Currency Derivatives And Equity Derivatives

BSE Registration No. : AP0107270199851 | NSE Registration No. : AP1657001401

We are affiliated to Suresh Rathi Securities Private Limited Under:

SEBI Reg. No. INZ000165734 (BSE/NSE) | CDSL : IN-DP-CDSL-22-99

————————

Segment Type: Cash And Currency Derivatives And Equity Derivatives

BSE Registration No. : AP0104460180183 | NSE Registration No. : AP0297112431

We are affiliated to Motilal Oswal Financial Services Limited Under:

SEBI Reg. No. INZ000158836 (BSE/NSE/MCX/NCDEX) | CDSL & NSDL : IN-DP-16-2015

@2022 Lalajiinvest, All Rights Reserved.

This will close in 0 seconds